Trading For A Living – Alexander Elder

Market Meditations | January 21, 2021

In today’s letter, we summarise Alexander Elder’s book Trading For A Living. We draw out the main takeaways that investors and traders could benefit from.

The 3 Pillars Of Trading

The first important takeaway is the idea of the 3 pillars of trading. Elder suggests that successful trading is built on 3 pillars:

1️⃣Trading Systems

2️⃣Psychology

3️⃣Risk Management

He uses the example of a three legged stool. Take away one of the legs and the stool will topple over, along with the person sat on it.

Here’s why:

- Risk management won’t help you if your trading system isn’t profit making

- There is no trading system that can compensate for poor risk management

- The best trading system and risk management frameworks will be worth nothing if you don’t have the discipline to stick with them.

? The first action for our readers is to have an honest look at their own trading and investing, and to understand whether they have the 3 pillars supporting them.

The Art of Technical Analysis

When analysing markets, Elder suggests we do not get overly reliant on one indicator but rather that we leverage the range of tools at our disposal to paint as complete a picture as possible ?

Elder uses the popular example of a man walking his dog to illustrate how trend following indicators and oscillators compliment each other.

“A man is walking his dog on a leash. The man leaves a fairly straight trail – like a trend following indicator. The dog’s trail swings left and right as far as the leash allows – like an oscillator. When the dog reaches the end of it’s leash, it’s likely to turn and run the other way.

You can follow the trail of a man to follow the trend of the pair. When the dog deviates from that trail by the length of its leash, it usually turns around. Usually, but not always. If a dog sees a cat or a rabbit, it may become excited enough to pull its owner off his trail.”

Trend following indicators like moving averages, MACD and directional systems are useful for identifying trends. It is usually profitable to trade in the direction of these.

Oscillators include stochastics, force indexes and of course, his very own: elder-ray. They are useful for identifying turning points and you often want to trade against the direction of these. For more on technical indicators, check out my FREE ? technical analysis course ?.

Different indicators have different purposes and it is worth using a combination of them. As Elder writes:

Knowing when to use oscillators and when to rely on trend following indicators is a hallmark of a mature analyst.

The 3 Screens Of Trading

Indicators often contradict other indicators and indeed themselves. That is, a one day chart might tell a different story compared to the one week chart.

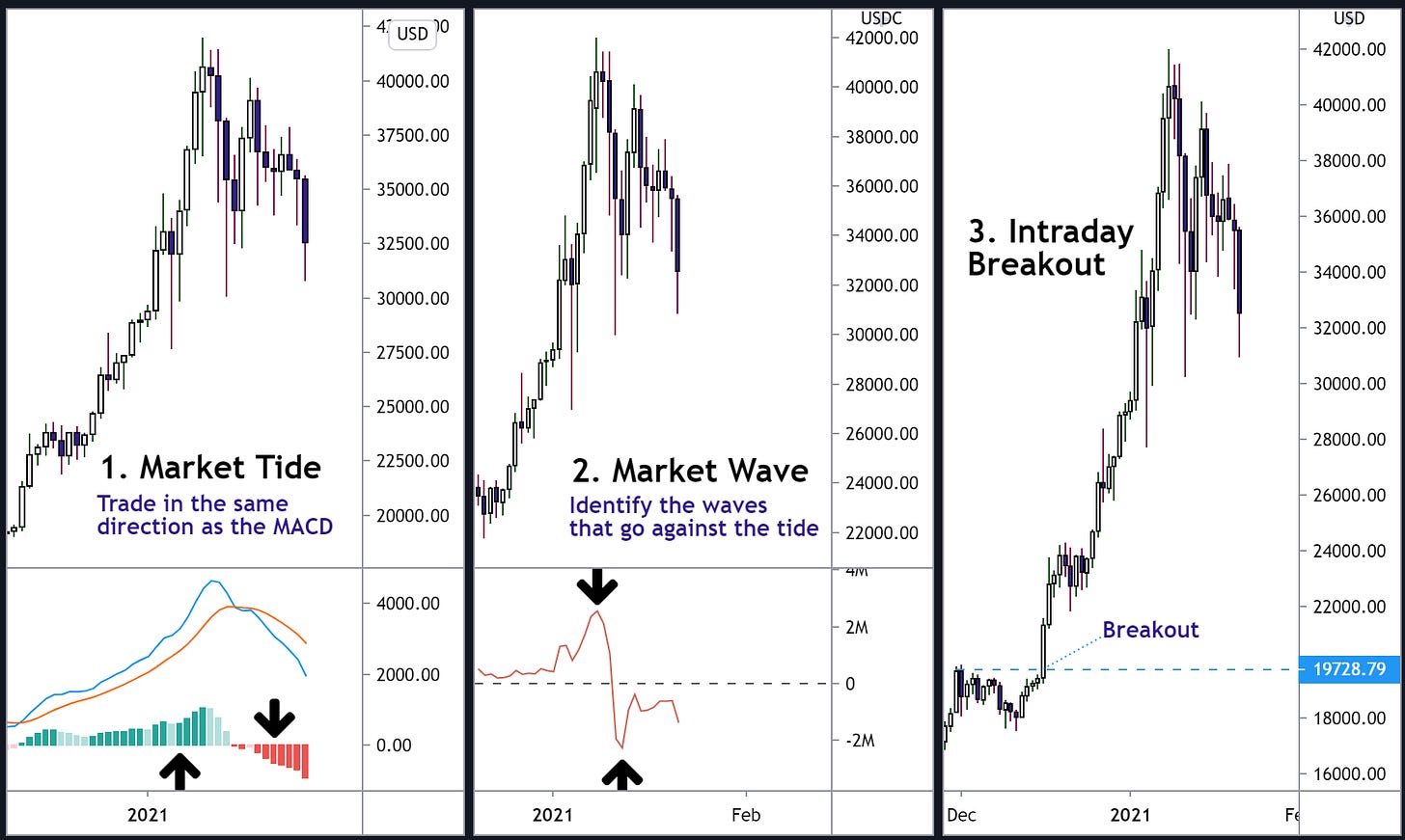

This is where Elder’s triple screen trading system comes into play.

- Market Tide – Only Trade in the Same Direction as the Weekly Indicator

The first screen identifies long term trends. As an example, Elder used the slope of a weekly MACD-Histogram. - Market Wave – Identify the Waves that Go Against the Tide

If your trade idea passes screen 1, you want to identify waves that go against the tide. That is, you want to time your entry. Elder used a 2 day EMA Force Index for this next example. He suggested using the oscillator to look for buying and selling opportunities; the lows and highs of the oscillator respectively. Think back to the far end of the dog’s leash, where he is likely to turn. - Intraday Breakout – Use a Trailing Buy / Sell Stop for your Entry

Ripples in the same direction as the market wave. This is a more deliberate entry technique. For buying when screen 1 and screen 2 allow for it, place a buy order one tick above the high of the previous day. Buy only if today’s price goes to that point, or higher.

Getting to Grips with Trading Psychology

Elder presents a thesis that many of us neglect: you need to spend as much time understanding yourself as you spend analysing the markets. His advice:

- Be Realistic. Success doesn’t come overnight. For more on this, check out our article on how to create 10x goals.

- Keep A Trading Diary. Monitor your trading to work on your weaknesses and leverage your strengths. If you don’t know how to get started, check out our step by step tutorial.

- Set Up Rules. Have these in place before entering any trade. At the very least, you should have a stop-loss and take profit level in mind.

- Don’t Overtrade. You don’t need to trade all the time, if you can’t find a high probability play, step out of the market temporarily. For more on this, check out our article on Jesse Livermore.

- Don’t Count Money. Try to think of the bigger picture. Aim for 6/10 profitable trades rather than aiming to never take a loss.

Risk Management

Elder emphasises that survival always comes first. No matter what the situation you must live to trade another day. For more on this, check out my FREE ? risk management course ?.

He suggests to never risk more than 2% of your equity in a single trade. This includes slippage and brokerage fees. He advises you have a stop loss in place to facilitate this. In fact, many great traders agree with this type of view. In our Market Wizards article, we explained how Ed Seykota would never risk more than 5% of his equity in any one trade.

Conclusion

Elder is just one of the few brilliant traders and authors who have created value add and potentially life changing knowledge. At Market Meditations, we will ensure you do not miss out on any of these. We have finished exploring Elder’s three pillars. Use the content of this letter to develop and strengthen your own foundation.