What Is Impermanent Loss

Market Meditations | July 6, 2021

?♂️ Cleaning Your Liquidity Pool

?♂️ What Is Impermanent Loss

Unfortunately, providing liquidity in DeFi isn’t quite as simple as just depositing, earning high yields and forgetting about the investment. Impermanent loss can occur and impact your profits. Impermanent loss = when you deposit funds into an automated market maker (AMM) and the price of your tokens change relative to each other. The bigger this change is ➡️ the larger the impermanent loss.

⚠️ TIP: don’t be fooled by the name. It’s only considered impermanent because it’s unrealised until you withdraw your funds. At the time of withdrawal, the losses can be very much permanent.

To better understand this, let us use an example as provided in Unmask Crypto?

- We deposit 1 ETH and 1,000 USDC in an ETH/USDC pool. Assume that there’s a total of 10 ETH and 10,000 USDC in the pool. The total liquidity in the pool is 20,000, and we have a 10% share of it.

- Suppose the price of ETH increases to 4,000 USDC. Arbitrage traders will keep removing ETH from the pool and adding USDC to it until the ratio of the assets in the pool reflects that price. (For more on crypto arbitrage trading check out our guide.)

- If 1 ETH is now worth 4,000 USDC, the ratio between the ETH and the USDC in the pool has changed. There is in fact 5 ETH and 20,000 USDC in the pool now.

- So, what happens if we want to withdraw? As we know, we have a 10% share of the liquidity in the pool. This means that, right now, we can withdraw 0.5 ETH and 2,000 USDC. That’s 4,000 USD, and we made some nice profits from our 2,000 USD deposit, right? Not quite. If we simply hold our original deposit of 1 ETH and 1,000 USDC, we’d now have assets worth 5,000 USD!

☝️ So this is how a loss in dollar value looks as a result of impermanent loss. This risk of providing liquidity can be off putting. As we have seen, for most AMMs, if there’s sustained price divergence between the time you deposit and withdraw liquidity, you’ll underperform a simple buy and hold strategy! Fortunately, there are ways crypto investors can mitigate impermanent loss.

? How Can Crypto Investors Mitigate Impermanent Loss

1️⃣ Consider Uneven Liquidity Pools

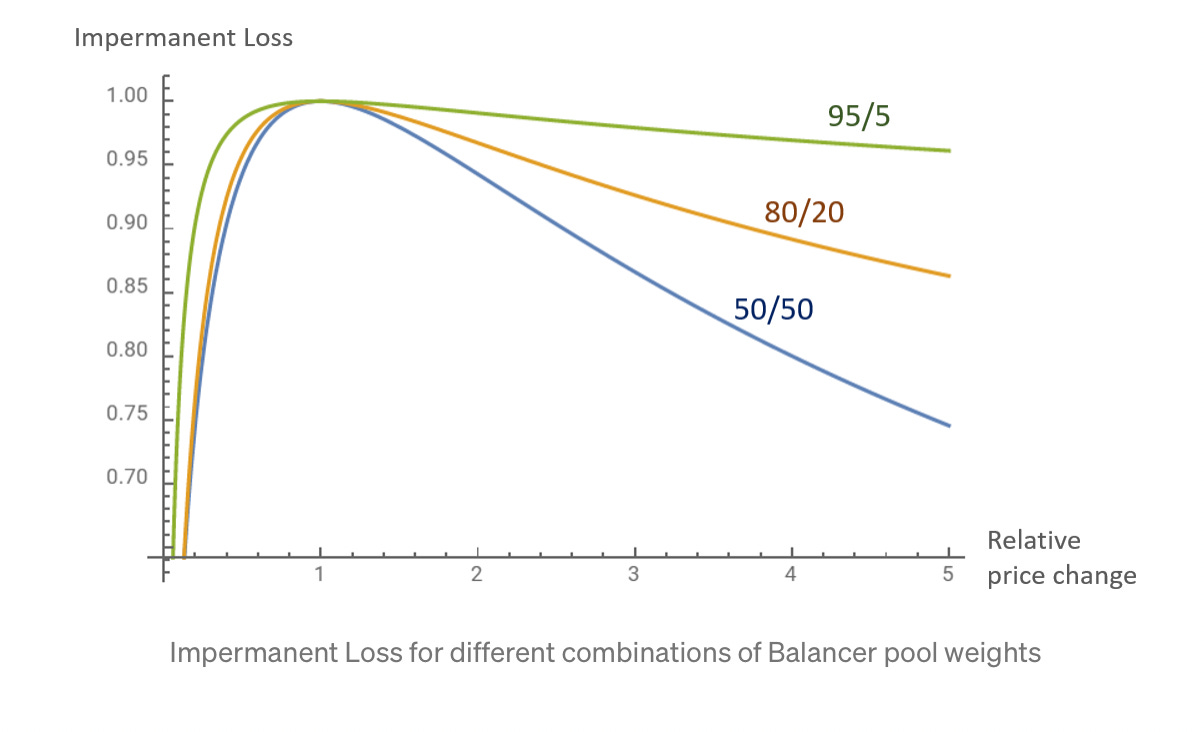

Uneven liquidity pools give you the freedom to employ asset ratios beyond the usual 50/50 split. Balancer is known for providing this flexibility. Allowing for 80/20 splits, for example. As explained on Balancer’s medium: With a 5x change in price, the impermanent loss for a standard 50/50 pool would be 25.4% whereas in a 95/5 pool it would be only 3.88%, over 6.5 times smaller ?

2️⃣ Select Assets That Remain In A Relatively Narrow Price Range

Providing liquidity with coins that do not have price fluctuations (e.g. stablecoins) allows you to benefit from the rewards of liquidity providing without worrying as much about impermanent loss. In contrast, crypto assets such as ETH are not pegged to the value of an external asset, so their value fluctuates per market demand.

Curve Finance is a good place to provide liquidity with a smaller risk of Impermanent Loss. As well as stablecoin pools, Curve also has a pool for different wrapped versions of BTC (we know that WBTC, renBTC and sBTC should remain in a tight range compared to each other).

3️⃣ Use Single-Sided Pools

Not all liquidity providing opportunities in DeFi come via two-token liquidity pools. There are also single-sided pools or staking pools such as Bancor. Staking pools are used to guarantee protocol solvency and only accept deposits of a single type of asset.

Here, you only deposit one token. Naturally, you’re not exposed to impermanent loss (there is no ratio balancing between two assets).

? Conclusion

DeFi and liquidity providing are here to stay. So too is impermanent loss. Much like the rest of the crypto space, for those who are willing to educate themselves and take precautions there is a lot of reward. We should be aware of the risks and the solutions at our disposal when it comes to mitigating them. It is precisely these challenges and barriers to entry that make the rewards high for those who can prevail. So prevail!