🧘♂️Beginner’s Crypto Conversion Guide

Market Meditations | July 5, 2022

Dear Meditators

We continue our FTX journey this week with an in-depth look at how to deposit into our preferred cryptocurrency exchange. FTX is still looking toward expansion while other exchanges and firms face insolvency issues.

Elsewhere, contagion remains a real threat as Celsius makes progress amidst insolvency uncertainty. Join us as we look into the events shaping our winter while awaiting the spring thaw!

Today’s Meditations:

- FTX Tutorial Part 2: Making Deposits and Claiming Rewards

- Celsius Trying to Stay Liquid

- Life After Crypto Winter

Delighted to say this article is brought to you by FTX.

Make sure to use our link to get a 10% discount. The first 1,000 users to sign up will get a $15 bonus.

Based in the U.S? Here’s a discount link for you: FTX.US.

⏰ Top Headlines

- UK government seeks public input on DeFi taxation

- Nexo starts process to potentially acquire troubled crypto lender Vauld

- Does the Senate Crypto Regulation Bill Scratch The Itch?

- ‘Almost Certain’ – ‘Wolf Of Wall Street’ Issues Bullish Bitcoin And Crypto Price Prediction As Ethereum, BNB, XRP, Solana, Cardano And Dogecoin Bounce

?FTX Volume 1, Part 2: Depositing and Earning

In Part 1 of our Beginner’s Cryptocurrency Exchange Guide, we showed you how to create an FTX account, verify your identity, and complete 2FA.

Today we cover how to deposit funds into FTX for trading and earning income, and use FTX’s unique “convert” feature to swap between coins. Not only does this feature allow you to trade coins with 0 fees, but the first 1000 people will also receive a $15 bonus. If you haven’t yet signed up to an FTX account, do so here:

- Residents of the EU and UAE, can sign up by clicking here.

- Residents of the US can sign up by clicking here.

Step 1: Completing Level 2 KYC

It’s important to complete Level 2 KYC to take advantage of all the features FTX has to offer. Without it, you will only be able to withdraw $2000 USD equivalent per day. After completion, however,unlimited crypto and fiat withdrawals are accessible. In order to receive the free $15 bonus, Level 2 KYC is required.

For a complete guide on completing Level 2 KYC on FTX, click here.

Step 2: Depositing Funds

Now that we’ve set up anaccount and completed Level 2 KYC, we’re ready to deposit funds.

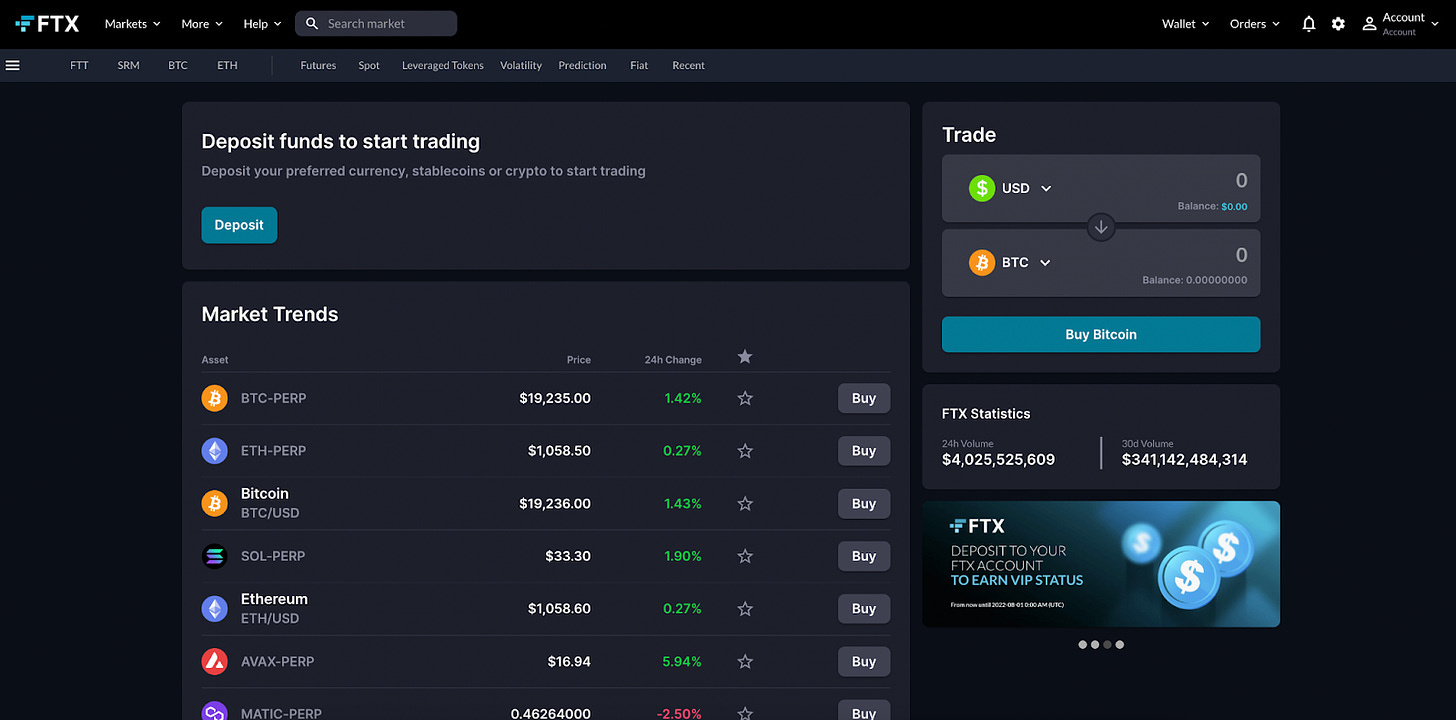

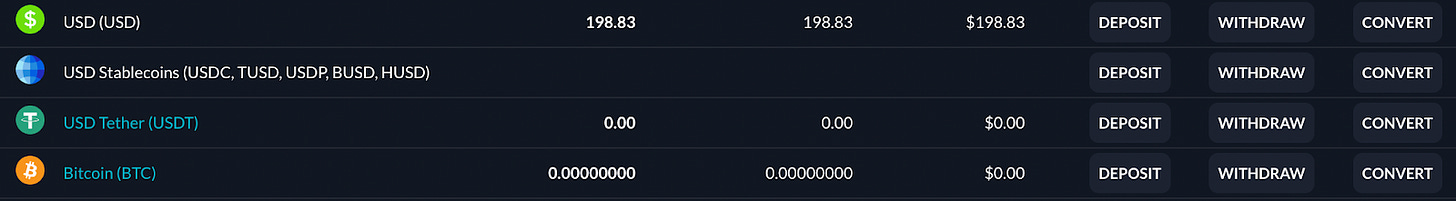

Click the FTX logo in the top left corner of the screen to navigate to a screen similar to the one above.

Click the blue “Deposit” button – if you have not yet completed Level 2 KYC you will notice that you will only be able to deposit USD stablecoins.

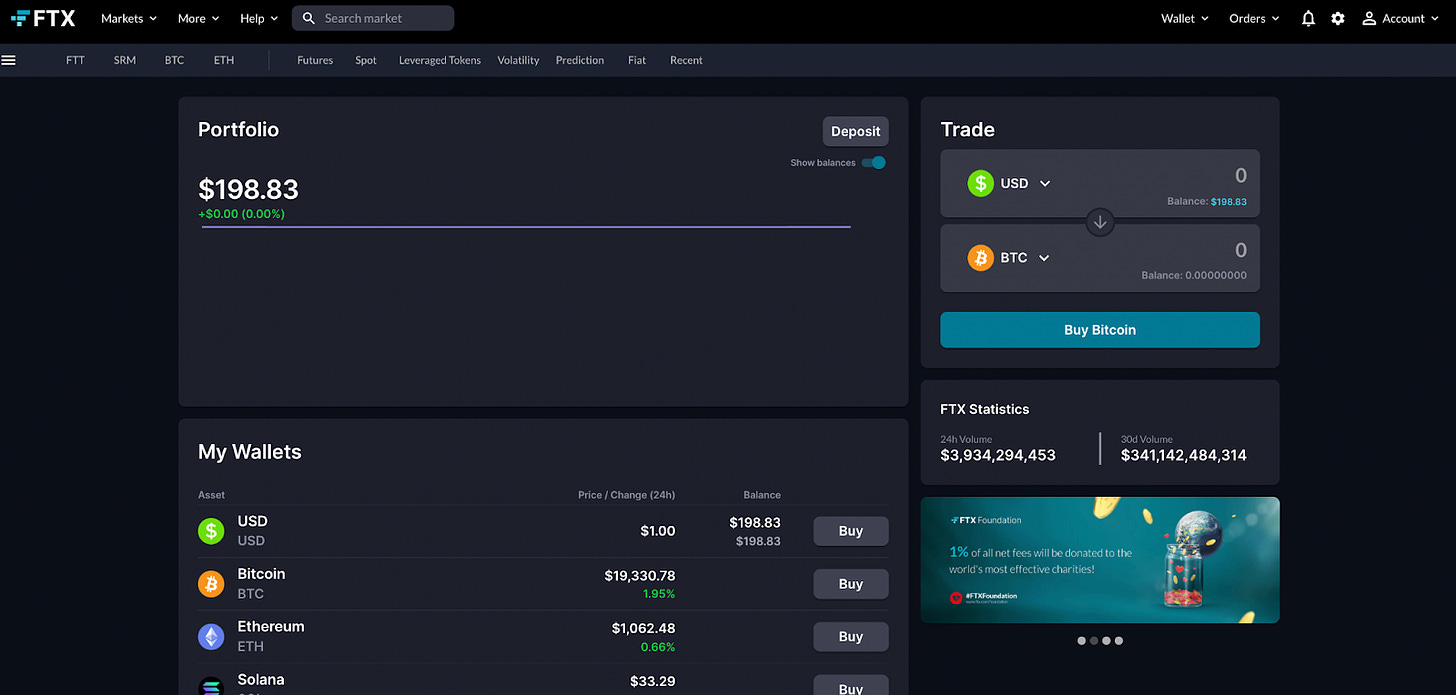

After depositing, the current balance will be displayed on the homepage, as shown below..

Step 3: Using FTX Convert

- The first 1000 users who convert at least $150 USD on FTX and the first 1000 users who convert at least $150 USD on FTX.US using the convert feature will receive a $15 bonus!

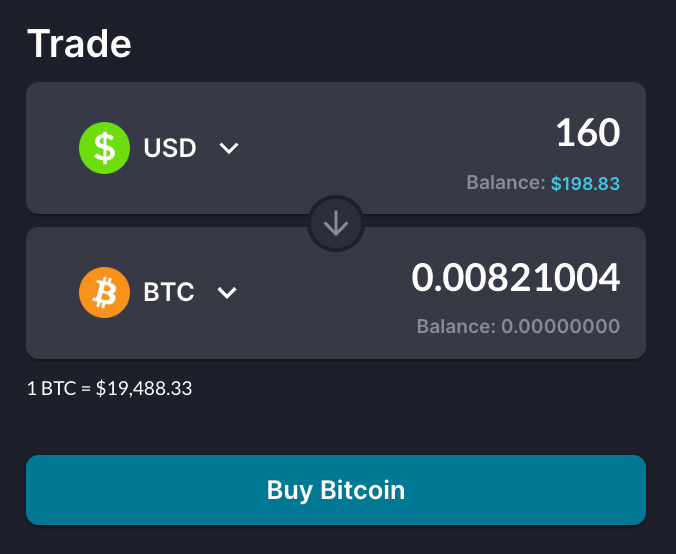

The FTX convert feature offers swapping between spot assets without having to navigate a complicated orderbook.. The best part? Using this feature means you can swap your assets with no fees. Note that the price quoted will depend on market conditions.

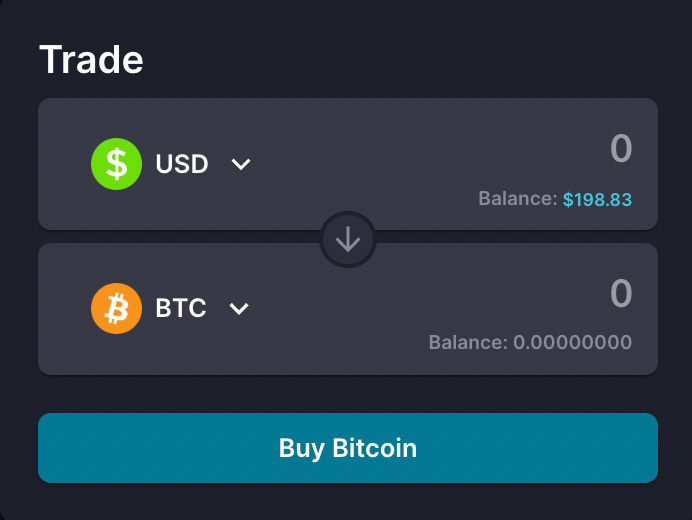

Let’s swap some USD for BTC.

- Notice on thehomepage to the right of thebalance there is a section labeled “Trade.” This is the convert feature and should look similar to the image above.

❗TIP:You can also access the convert feature by clicking on ”Wallet” in the top right corner of the screen and then clicking convert next to “Deposit” and “Withdraw” on the desired coin as shown below.

All that’s left to do is enter the desired quantity you’d like to convert.

For example, when converting 160 USD to 0.00821004 BTC at a price of $19,488.23 as shown below, clicking “Buy Bitcoin” completes the process!

Remember! The first 1000 users who convert at least $150 USD on FTX and the first 1000 users who convert at least $150 USD on FTX.US using this convert feature will receive a $15 bonus! The Free Bonus will be credited in USD immediately upon successful completion of the steps.

Congratulations! You’ve deposited funds, set up Level 2 KYC, and converted your first spot assets with 0 fees.

Next week, we will be sharing Part 3, where we will show you how to complete withdrawals.

?️ A Heated Update on Celsius Insolvency

Celsius, a centralised crypto-staking platform, has recently become an infamous household name. On June 12th, the firm suddenly froze all withdrawals and transfers on its platform due to fears of insolvency, leaving 1.7 million users unable to redeem their assets.

- Issues began to arise due to “extreme market conditions” initiated by the collapse of Terra LUNA, and fears of Celsius being insolvent caused further panic.

- As of May 2022, Celsius had lent out more than $8 billion to clients and, at its peak, had $12 billion in assets under management.

- According to an official blog announcement on June 30th, Celsius had begun exploring options to “preserve and protect assets” following insolvency issues.

- Celsius states that these actions included “pursuing strategic transactions” and “restructuring its liabilities”, among other strategies.

- Earlier this week, FTX pulled out of a potential deal to acquire Celsius after finding a $2 billion hole in the firm’s balance sheet.

Celsius seems to be moving in the right direction, as they were able to pay another $120 million towards its Bitcoin loan on Maker protocol.

- After this payment, its new liquidation price on the position sits at $4,966.

- By paying this debt, Celsius has significantly de-risked its risk of liquidation.

- According to Zapper’s data, Celsius still owes $82 million to Maker, $100 million to Compound and $175 million to Aave.

❗Tip: In DeFi, liquidations occur when traders cannot repay their loans on time, and the protocols automatically sell their collateralised assets.

? Survive and Thrive

If you survive crypto’s nuclear winter, what remains on the other side? Upon finally leaving the cave, you might just find that there is a new balance of power in place… for it is the early bird that catches the worm.

- Lots of crypto lenders and exchanges have been bitten this year by offering credit lines to counterparties running high-risk practices.

- Double-digit returns must come from somewhere, and it is likely that at the end of the chain of borrowers was a high-risk DeFi application or leveraged trade.

- Singapore-based firms are some of the hardest hit, the most notable example being 3AC, but also smaller companies like crypto exchange Vauld, which froze withdrawals yesterday.

- For companies in stronger positions, they can not only survive but thrive in the fallout.

- Nexo has been working with Citibank since last month to advise on how to sweep up some good deals through acquisitions.

- Today they signed a term sheet with Vauld to start due diligence with a view to buying up to 100% of the firm.

- Others like Binance and FTX / Alameda are also looking to consolidate their powerful positions by continuing to hire and invest in different parts of the market.

As the market resets, one cannot help but wonder whether this further centralisation of crypto is what Satoshi envisioned. The king is dead – long live the king.

?♂️ Ethereum: Can ETH Beat The BEAR Market?

For today’s top headlines, head over to the Market Meditations YouTube where you can watch our Market Update Video.

- Crypto lender @Nexo plans to acquire 100% of its rival Vauld. Customer withdrawals remain halted on Vauld’s end for now – CoinGecko

- The @bankofengland Financial Stability Committee called for enhanced regulation to mitigate against the risks that crypto assets might pose to the wider financial system. @camomileshumba reports. – CoinDesk

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Isambard FA, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.