🧘♂️Big Updates For Ethereum

Market Meditations | June 16, 2022

Dear Meditators

Ethereum’s upcoming merge will mark the transition from proof of work to proof of stake. Doing so has many opportunities and risks, especially given the current market conditions.

Other notable events include the outcome of the FOMC Meetings and how crypto companies such as Coinbase and Kraken are responding to the more challenging conditions.

Today’s Meditations:

- Latest on the Ethereum Merge

- Coinbase and Kraken React to Market Conditions

- Everything You Need to Know About the FOMC Meetings

This article is brought to you crypto.com, the world’s fastest growing crypto app.

- ✅ Deposit crypto, earn rewards.

- ? Choose from 40+ cryptocurrencies and stablecoins.

- ? Up to 14.5% p.a. on cryptos.

- ? Up to 10% p.a. on stablecoins.

You can use our link to download the crypto.com app and receive CRO rewards.

⏰ Top Headlines

- XDEFI integrates with the Fantom and Arbitrum blockchains

- Tron DAO to withdraw another 3 billion TRX from exchanges

- Circle launches euro-backed stablecoin EUROC

- Metaverse could be worth $5 trillion by 2030: McKinsey report

? Ethereum 2: The Mergening

1️⃣ Proof of How Ethereum Works.

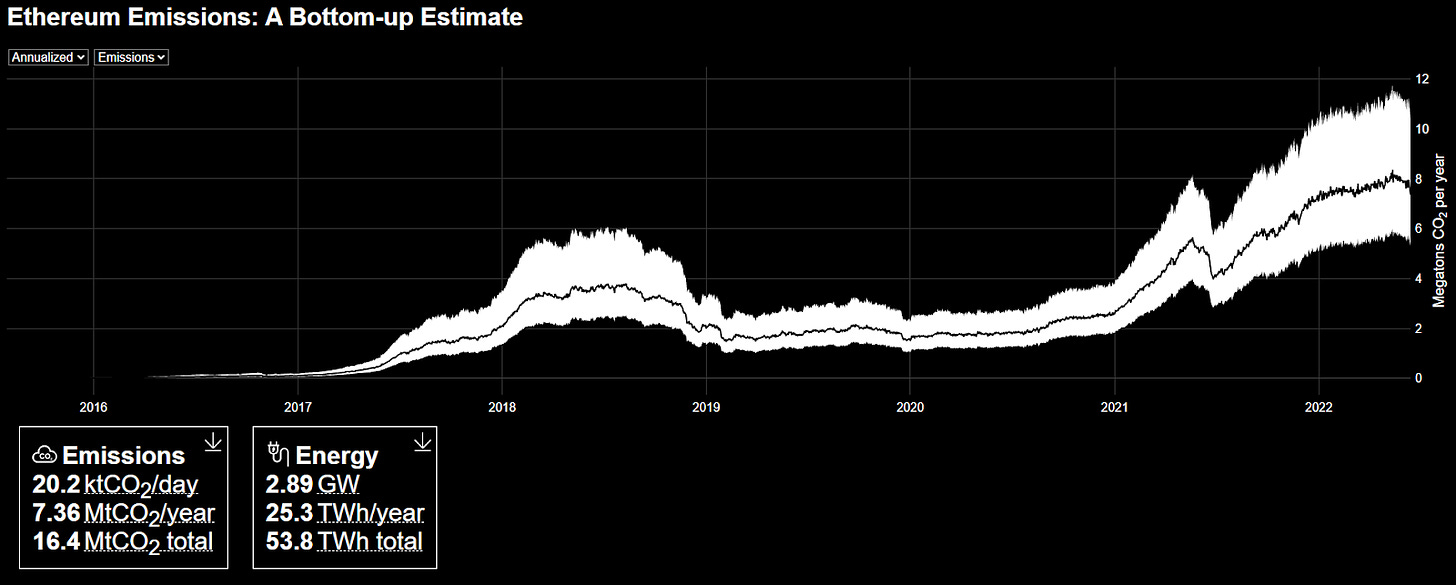

KyleMcDonald.github: Ethereum Emissions: A Bottom-Up Estimate

As represented above the impact of Ethereum’s energy consumption has been consistently growing as the network sees wider adoption.

To know where we’re going, we have to examine where we’ve been.

- Powering down. At the current rate, Ethereum consumes about as much energy as The Netherlands. The merge is estimated to reduce the network’s energy consumption by 99%.

- Sales pressure. The merge eliminates the need for miners. Without parties who need to constantly sell ETH to pay for operational costs, this steady flow of market supply will no longer exist.

- It’s easy being green. Previously hesitant Environmental, Social and Governance (ESG) conscious investors will be more eager to engage a far more energy efficient network.

- Cutting emissions. Post-merge, ETH’s token emission rate will drop from about 4% to under 0.5%. That makes EIP-1559’s burning mechanism much more effective, transforming Ethereum’s inflation rate (~3.7%) to a deflation rate of up to 2%.

2️⃣ Opportunities Knocking?

An event this big carries with it great opportunity.

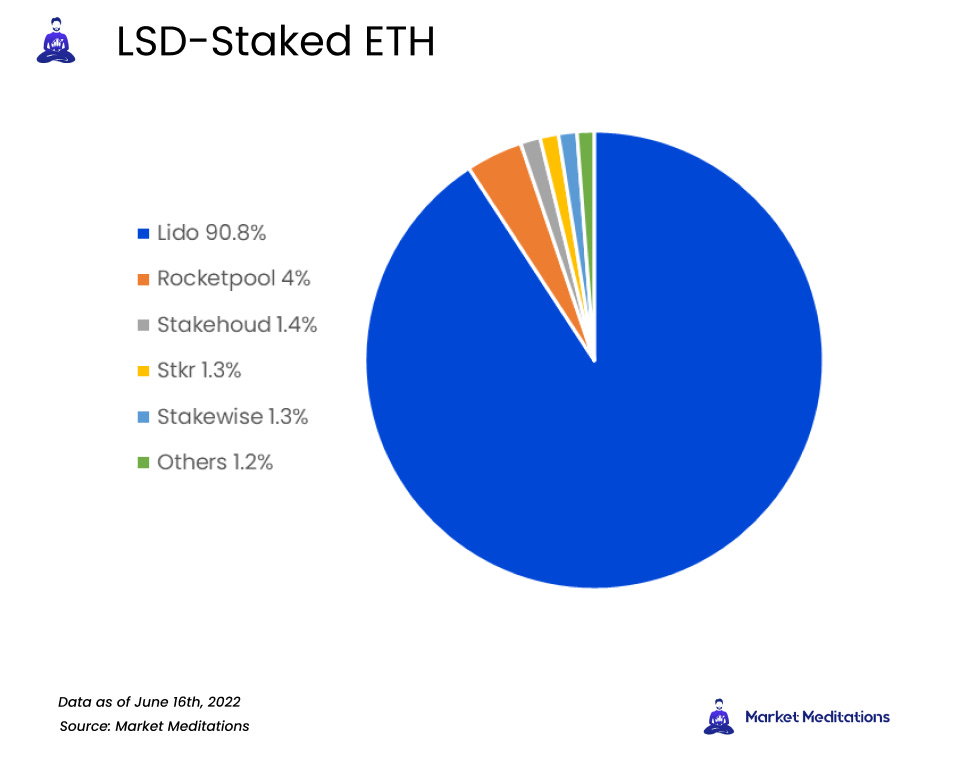

- Lido’s stETH is currently trading at ~6% discount against ETH via 1inch. According to Lido, stETH will be redeemable for ETH at a 1:1 ratio approximately 6 months after the completion of the merge.

- Rocketpool, another liquid staking solution, is also offering rETH at a smaller discount (~3%), but can be a valid option for those looking to diversify.

- Holding ETH itself could prove lucrative if things go off without a hitch. In a best-case scenario, the price of Ether is poised to increase following the upgrade.

3️⃣ The Risk of Reward.

Many things have to fire correctly to achieve success. In a crypto bear market, there is no room for error. Be sure to consider each of the following:

- Not a sure thing. Fundamentally changing the way Ethereum runs comes with risks. Yes, the code has been audited, testnets have been stood up and stress-tested, merges will be completed in test environments, but if the merge fails, so will ETH’s price.

- Not so fast. The merge has been delayed before, and it definitely could be delayed again. News of another delay could send prices into a downward spiral.

- The price is right. The merge is big news, and markets could have already priced in a successful upgrade. This might result in underwhelming upside upon publication of news.

- Dumped on. When the merge completes, staked ETH will unlock soon after. Lido alone currently has over $5 billion worth of ETH staked. An unlocking supply of that size has the power to flood the market and drop the price.

- Market conditions. It’s still brutal out there. The merge is a wonderful narrative, but we could see bullish fundamentals overshadowed by bearish presence resulting in investors’ disappointment.

Liquid Staking Derivatives (LSDs) make up the ETH2 liquid staking balance. Of all platforms offering these services, Lido currently has over 90% of the market.

⁉A word on Lido: There are currently over 4.2 million ETH staked by Lido Finance, making it the largest provider of staking services on the network. Unfortunately, it also poses a debatable risk to the centralization of Ethereum 2.0. Any one entity controlling more than ⅓ possession of all staked Ethereum would present a risk of a centralisation attack.

If properly researched and managed, ETH 2.0 presents some undeniable investment opportunities, but going all-in on an unknown shouldn’t be anywhere on a responsible investor’s radar.

↔️ Different Directions

This week, we look at Coinbase and Kraken — two big players who are handling this market period very very differently. First, we look at Coinbase’s layoffs, and then we will look at Kraken’s policies that are causing controversy.

Coinbase

- Earlier this month, Coinbase announced that they would be extending their hiring freeze.

- A recent email sent out to employees informed them that Coinbase will be cutting 18% of full-time jobs – roughly a cut of 1,100 employees.

- Their CEO, Brian Armstrong, says, “While it’s hard to predict the economy or the markets, we always plan for the worst so we can operate the business through any environment.”

- Coinbase says that these cuts are a result of growing “too quickly” during the bull market.

Kraken

- While most other exchanges are laying off workers, Kraken is hiring – but not for workers who go against company values.

- There is controversy surrounding Jesse Powell and his company’s vision. As a result, he is offering 4 months’ pay to employees who don’t agree with their principles to leave.

- They explain their culture in a blog post saying things such as, “We do not call someone’s words toxic, hateful, racist, x-phobic, unhelpful, etc.” and “We do not demand respect, be we encourage offering it.”

- While some pushed for change at Kraken, they were told that the company culture would not make meaningful change – they are a “crypto-first culture.”

Though the markets are not trending upwards, we see two big exchanges handling these market conditions very differently in terms of their respective staffs.

? The FED and Spiralling Inflation

The US Federal Reserve (FED) holds eight meetings a year. Last month they announced that they would use the six remaining FOMC meetings to combat spiraling inflation.

- The first of the six major FOMC meetings concluded in early May when interest rates increased by 50 basis points, which was the highest hike in the last two decades.

- Yesterday on the 15th of June, the second of the six major FOMC meetings concluded with the FED voting to raise interest rates by 75 basis points.

- The market expected an increase, and this hike was the largest move in a single FOMC meeting since 1994.

- Consumer Price Index (CPI) inflation accelerated to a 40-year high of 8.6% in May, currently sitting more than four times the FED’s long-run inflation target of 2% a year.

- FED officials are now projecting a year-end rate of 3.4%, far exceeding the initial projections of 1.9% from March.

✅ Tip: Each basis point is 1/100th of 1%, meaning a 50 basis point increase would equate to a move of 0.5%.

How will this likely affect the crypto markets?

- The market was expecting a 75 basis point increase. According to CoinGecko, 24 hours after the announcement, BTC increased by 5.0%, ETH increased by 9.7%, and the total crypto market cap increased by 4.5% to $952 billion.

- After last month’s FOMC meetings, the crypto market experienced a minor pump. However, this seemed to rally a higher low to liquidate shorts before dumping further.

Current macro conditions continue to worsen, making it increasingly difficult to predict market movements. To help you navigate the volatile market moves, check out our guide on ‘How To Thrive In a Bear Market’.

- To safeguard the overall blockchain industry and crypto market, TRON DAO Reserve will withdraw another 3 billion #TRX out of Cefi exchange and Defi lending platform. – TRON DAO Reserve

- Andrew Grass helped hire about 200 people at Coinbase earlier this year. Now most of those hires — and Grass himself — are gone – Bloomberg Wealth

- Inverse Finance drained for $1.2 million in a flash loan attack. By @vishal4c – The Block

? Act

- Check out Ethereum emissions.

- Research Lido alternative, Rocketpool.

? Watch

- Vitalik Buterin’s vision for the future of crypto.

? Read

- Educate yourself with Ethereum.

- Read about the risk of centralisation.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.