🧘♂️Our Crypto DAO Strategy

Market Meditations | July 1, 2022

Dear Meditators

DAOs represent one of the hallmarks of cryptocurrency, bringing with them decentralised governance and a voice for token holders. While the advantages of this architecture are convincing, every rose has its thorns. Weeding out the noise to appreciate opportunity is difficult without the right tools.

Come get DAOn with us as we outline exactly how to identify top DAO opportunities.

Today’s Meditations:

- DAO Treasuries Defined

- Mining Activity Mellows Out

- Arbitrum’s Odyssey Continues

With Nansen’s On-Chain data, you get an edge over everyone else by tracking the behaviour and on-chain activity of prominent wallet addresses.

- Exciting New Opportunities. Follow Smart Money, identify new projects, and trace transactions down to the most granular level.

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

Every Wednesday, we share new ways you can use Nansen to profit in the crypto markets. So simply sign up and follow along!

⏰ Top Headlines

- Three Arrows Capital Liquidation Ordered in British Virgin Islands

- MakerDAO looks to invest $500M into ‘minimal risk’ treasuries and bonds

- Early-stage Solana-backer Reciprocal Ventures launches $70 million fund

- Compass Mining CEO and CFO Resign Amid ‘Setbacks and Disappointments’.

?♀️ It’s Going DAOn For Real

In part 1 of this series we outlined exactly what a DAO is, and how anyone can find top DAOs to get involved. In part 2, we will demonstrate how to dive deeper into DAO treasuries in order to vet potential opportunities.

DAO Treasuries

DAOs are a fantastic way to get involved in the space, whether to network, learn more about your favourite protocol, or simply to find opportunities for profit. Understanding what assets a DAO owns can be essential in deciding which projects you want to contribute to. Using Nansen we can see:

- The dollar value of their liquid assets: Will the DAO be able to achieve its goal with the amount of resources they have?

- Portfolio allocation: Do they hold volatile assets that may decrease in value or do they hold stable assets such as USDC?

- Token holdings: Who are the key stakeholders? Does the DAO have faith in other projects?

Last week we identified the largest DAO by liquid assets – BitDAO. Let’s dive into their holdings:

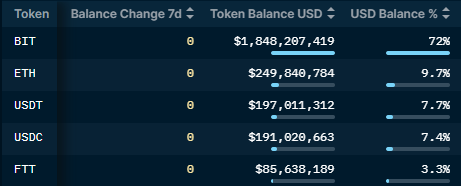

Nansen.ai: 29/06/2022 – BitDAO – DAO God Mode – DAO ETH and Token Balances

- BitDAO has liquid assets worth a total of $2.6bn, showing they have resources to enact significant change in the crypto industry.

- 72% of the USD value within these assets is generated from their own token BIT. This is common for DAOs, but does demonstrate the potential volatility within their treasury.

- They hold an $85m position in FTX’s native token (FTT). We can see from the proposal on BitDAO exactly why this is the case.

✅ Tip: Nansen also shows the wallet addresses that hold the these assets. This allows us to dive even further, looking at specific transactions or any holdings placed in other locations.

DAOs propose a new type of governance structure that has the potential to solve key issues within today’s organisations, including a lack of transparency and hierarchical models. There are a variety of DAO structures, each with different degrees of potential for their members.

Using Nansen, we are able to identify top DAOs, understand who controls them, and see a breakdown of their liquid assets. This allows us to decide exactly which DAO we want to spend our time contributing to.

⚒ Evacuate The Mine

Bitcoin difficulty for miners has plateaued in recent months and is slightly down from its high in May. What’s happening in the mining world, and why have things slowed down?

- Bitcoin more than halved in price during Q2 of this year and the reasons behind this and knock-on effects are well documented.

- This has impacted the earnings of miners, whose Bitcoin rewards for block validation are sometimes cashed out immediately.

- Consequently there has been a flood of mining hardware into the market, with some high-end graphics cards now trading at a discount of 45% from where they were a few months ago.

- This is not necessarily a bad thing, as gamers and other retail participants looking for cards can now find them at prices closer to manufacturer’s recommendations.

- Elsewhere, a large storm in Montana has knocked out 75% of Marathon Digital Holdings mining power.

- According to blockchain explorer, the miners seem to have been out for about 2.5 weeks.

The damage is believed to be mostly at the nearby power station rather than the actual mining equipment, and 0.6 Exahash per second is still operational via third party mining pool. The company is looking for new locations to move its equipment to prevent similar future outages.

? Be the Bank, Week 2 of Arbitrum Odyssey

The Arbitrum Odyssey is in full swing! Attempts to bring crypto users to the layer 2 chain began with bridge week, resulting in more than 43,000 ETH being bridged to Arbitrum. Week 2 activities have been announced and include liquidity provider activities on Yield Protocol and GMX.

- To collect the Arrival on Penumbra NFT for Yield Protocol, one of the following objectives must be completed.:

- Provide liquidity of $50 or more.

- Lend a minimum of $50 worth of assets on the protocol.

- Borrow $100 worth of assets using the supported collateral.

- To collect the Blueberry Nebula NFT offered by GMX, a decentralised perpetual exchange, you must complete all 3 activities, each one having a $10 minimum (excluding gas fees).

- Make a leveraged trade.

- Provide liquidity by minting GLP.

- Do a spot swap on GMX.

If you are having trouble completing the tasks, this medium article comes equipped with screenshots.

Users who were able to successfully claim the Odyssey NFT may also be eligible for bonus drops from the bridges they used, with bridges like HOP releasing its own participation NFT. Even some wallets, like IMToken are offering bonus collections for users who do the Odyssey using their wallet.

Even if not looking to build an NFT collection, participating in the Odyssey campaign will advance user knowledge of the Arbitrum network and some of its most popular protocols, making for a more informed investor.

Twitter

- The liquidation of crypto hedge fund Three Arrows Capital (3AC) has been ordered in a court in the British Virgin Islands, according to a Sky News report. By @JamieCrawleyCD – CoinDesk

- MicroStrategy has purchased an additional 480 bitcoins for ~$10.0 million at an average price of ~$20,817 per #bitcoin. As of 6/28/22 @MicroStrategy holds ~129,699 bitcoins acquired for ~$3.98 billion at an average price of ~$30,664 per bitcoin – Michael Saylor

- EXCLUSIVE: @SBF_FTX tells Forbes that more crypto exchange failures are coming. “There are some third-tier exchanges that are already secretly insolvent,”: by @Steven_Ehrlich – Forbes Crypto

It’s no coincidence that institutions like Celsius and Three Arrows Capital are facing tough times lately. As the price of BTC falls, vulnerabilities seem to be rising to the surface every week across the industry. How do we interpret the ripple effect resounding throughout the crypto space? And what does it mean for the average retail investor?

Tomorrow we take a look behind the curtain to find out what’s gone wrong and how it could play out in the weeks ahead.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.